The firm won’t discuss specific cases of alleged wrongdoing, citing client confidentiality. What does Mossack Fonseca say about the leak? From June, UK companies will have to reveal their “significant” owners for the first time.

It wants to set up a central register that will reveal the beneficial owners of offshore companies. The government is trying to do something about this. In a speech last year in Singapore, David Cameron said “the corrupt, criminals and money launderers” take advantage of anonymous company structures. Are some people who use offshore structures crooks? Others use offshore for reasons of inheritance and estate planning. Business people in countries such as Russia and Ukraine typically put their assets offshore to defend them from “raids” by criminals, and to get around hard currency restrictions. There are many legitimate reasons for doing so. Using offshore structures is entirely legal. Panama Papers: Biggest leak in history Are all people who use offshore structures crooks? Mossack Fonseca operates in tax havens including Switzerland, Cyprus and the British Virgin Islands, and in the British crown dependencies Guernsey, Jersey and the Isle of Man. It has franchises around the world, where separately owned affiliates sign up new customers and have exclusive rights to use its brand. Its website boasts of a global network with 600 people working in 42 countries.

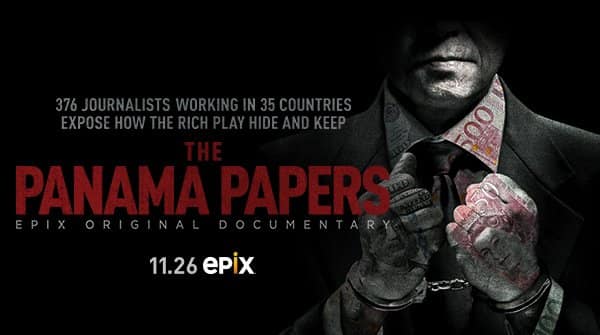

The firm is Panamanian but runs a worldwide operation. Other services include wealth management. It administers offshore firms for a yearly fee. It is a Panama-based law firm whose services include incorporating companies in offshore jurisdictions such as the British Virgin Islands. The fund has been registered with HM Revenue and Customs since its inception and has filed detailed tax returns every year.Ī lengthier overview of the revelations can be found here. Some of it ends up in a ski resort where in 2013 Putin’s daughter Katerina got married.Īmong national leaders with offshore wealth are Nawaz Sharif, Pakistan’s prime minister Ayad Allawi, ex-interim prime minister and former vice-president of Iraq Petro Poroshenko, president of Ukraine Alaa Mubarak, son of Egypt’s former president and the prime minister of Iceland, Sigmundur Davíð Gunnlaugsson.Īn offshore investment fund run by the father of British prime minister David Cameron avoided ever having to pay tax in Britain by hiring a small army of Bahamas residents to sign its paperwork. The Russian president’s best friend – a cellist called Sergei Roldugin – is at the centre of a scheme in which money from Russian state banks is hidden offshore. Twelve national leaders are among 143 politicians, their families and close associates from around the world known to have been using offshore tax havens.Ī $2bn trail leads all the way to Vladimir Putin. The documents show the myriad ways in which the rich can exploit secretive offshore tax regimes.

0 kommentar(er)

0 kommentar(er)